Table of Contents

Top 10 Crypto Exchanges with lowest Fees

Here is the list of Top 10 Crypto Exchanges with lowest Fees;

| S. No. | Exchange | Spot Trading Fee | Futures Trading Fee | Native Coin | VIP Requirements |

| 1 | MEXC | 0%(MX holders) | 0-0.01% | MX | Not Applicable |

| 2 | BYDFi | 0.10%-0.30% | 0.02%-0.06% | Not Applicable | Not Applicable |

| 3 | Binance | 0.10% | 0.02%-0.05% | BNB | 25BNB+$1M volume |

| 4 | BingX | 0.10% | 0.014%-0.04% | Not Applicable | $1M volume or $50K Assets |

| 5 | Bitget | 0.10% | 0.02%-0.06% | BGB | $1M volume or $50K Assets |

| 6 | Bybit | 0.10% | 0.02%-0.0551% | Not Applicable | $100 Assets |

| 7 | CoinEx | 0.20% | 0.03%-0.05% | CET | $10K volume+$10K Assets |

| 8 | OKX | 0.08%-0.10% | 0.02%-0.05% | OKB | $100K Assets or $5M volume |

| 9 | Kraken | 0.25%-0.40% | 0.02%-0.05% | Not Applicable | $10K volume |

| 10 | NewExchange | 0.15% | 0.02%-0.04% | NEX | Not Applicable |

Cryptocurrency Trading Fees

The amount of fee that is charged on buy or sell orders on the cryptocurrency trading platforms is known as Trading fees. The amount of fees charged on the trades varies from one exchange to other.

Broadly, there are three categories of fees:

Spot trading fees

It is charged on cryptocurrency trades in spot.

Futures trading fees

It is charged on trades in futures.

Withdrawal fees

It applies when you make any withdrawals from the cryptocurrency exchange.

Maker Fees Vs Taker Fees

Within Spot Trading there are Maker Fees and Taker Fees

Maker fees has to be paid when you place a limit order, thereby adding liquidity to the market. Limit order is usually set at prices different from the current or market price of the crypto-coins. This is done to maximise/minimise gains/losses while making spot trades.

Taker Fees are the opposite of Maker Fees which apply when you remove liquidity from the market by executing the order.

How Trading fees impacts?

Choosing the platforms with lower trading fees becomes important particularly for those which perform frequent orders. In doing so they may lose a big amount of their assets towards the platforms in the shape of fees.

However, many exchanges like MEXC offer far lower trading fees when you have some of your assets in their native coin. The trading fees is deducted from the native coin which can be MX for MEXC or BNB for Binance depending on the exchange.

Strategy to pay no fees on crypto trades

There are ways to perform crypto-trades with much lower or zero trading fees:

Trading Free Exchanges

MEXC- You can trade on MEXC exchange with 0 fees in spot while holding its native token MX

Robinhood- It offers free of cost buying and selling of crypto on their exchange.

Use of Native Coins-

Most of the exchanges offer their native coins to further minimize the trading fees.

- MEXC- NO fee for MX holders

- OKX- It offers reduced fee for OKB, their native token, holders

- Bitget- Reduced fees for BGB holders.

- CoinEX- Offers reduced fees for CET holders.

Artificial Intelligence based crypto-coins are right now trending in the market. Here is the list of Top 10 AI base cryptocurrencies which you can’t afford to miss in this bull market.

Completing Tasks

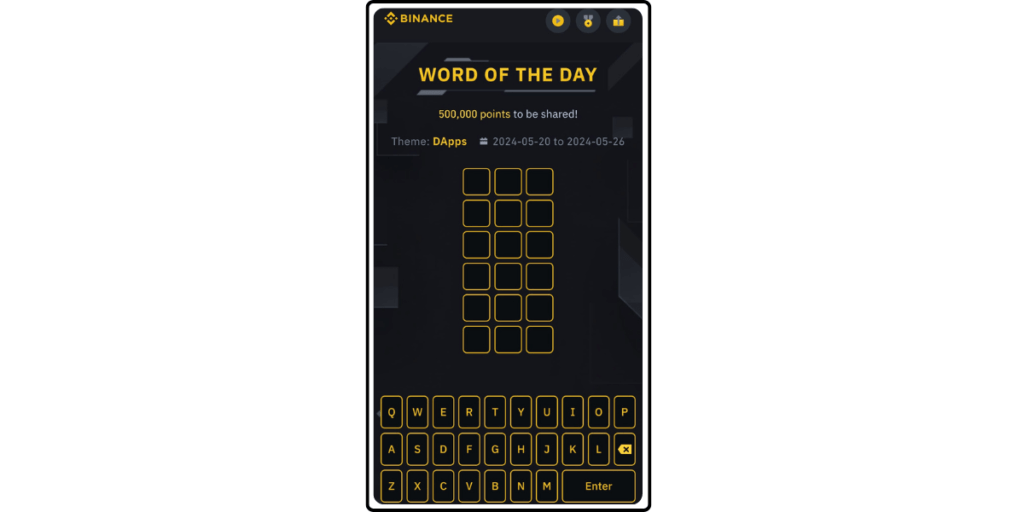

There are ways with which you can trade with zero trading fees. For example, in case of Binance the most popular exchange offers certain trading fees vouchers which can be availed and activated to enjoy free of cost trading.

These vouchers can be earned by completing their quests like Word of the Day(WOTD) challenge, where you need to guess the word related to the already given topic.